An economist at a leading libertarian think tank argues President Barack Obama and Congress’ recently successful effort to keep interest rates for college loans artificially low will eventually increase overall tuition costs and hurt higher education’s longterm health in many ways.

Dr. Mark Thornton, an economist at the Ludwig von Mises Institute, said in an interview with The College Fix that it was a mistake for Obama and Congress to prevent federal student loan interest rates from doubling.

Thornton opined the move by Washington lawmakers, done over the summer, will ultimately attract students to college who are better served learning a trade or attending a vocational school, and send a signal to colleges that students can afford more, which will increase tuition and fees.

“Federally backed low interest loans are one way the government subsidies higher education,” he said. “By reducing the overall price of higher education it encourages the marginal student to go to college rather than get a job, training and experience. This represents an increase in total demand for college education.”

The president’s and Congress’ actions were an attempt to address a serious problem. According to InflationData.com (using both figures from the government and from independent sources such as CollegeBoard), the cost of college tuition has risen nearly 500 percent over the past twenty-five years, more than four times the rate of inflation.

Obama has also always pushed the notion of making higher education more affordable.

“I’ve always believed that we should be doing everything we can to help put higher education within reach for every single American student … it’s never been more important,” Obama said in a press conference with college reporters.

To that end, in late June, Obama and Congress successfully prevented federal student loan interest rates from doubling from 3.4 to 6.8 percent, in part by Obama’s encouragement to students to be vocal supporters of the measure. He even told them to use Twitter for the cause.

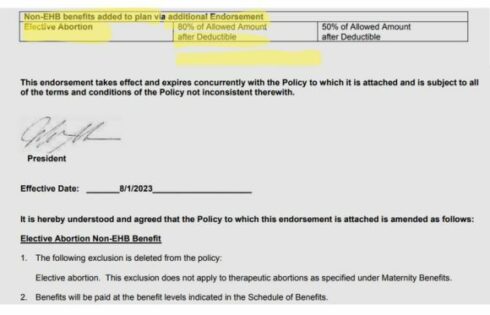

Conveniently, this came after an earlier initiative of the president’s—signed into law as part of the Affordable Care Act of 2010 (Obamacare)—that eliminated the role of private banks in the student lending process.

Peter Schiff, president of EuroPacific Capital and a Senate candidate at the time, voiced outrage over the situation.

“Loaning directly to students while reducing the amount a student is required to repay will actually encourage colleges and universities to increase tuitions even faster, as students will be more willing to assume larger debts which they are not legally required to repay,” Schiff commented. “Not only will this bill cause tuitions to rise faster, but contrary to Obama’s claim, it will substantially increase the cost to taxpayers who will be forced to pick up a much larger share of inflated tuitions and absorb bigger losses on defaulted loans.”

Thornton, in his interview with The College Fix, explains further, noting that Obama’s plans to ostensibly make college more affordable will inadvertently increase the cost of higher education. By keeping interest rates artificially low, Obama actually sends a signal to colleges that students can collectively afford more, thus incentivizing expansion and the increase of tuition and fees, he said.

Economist Doug French likens the dramatic increases in the cost of higher education to the recent housing bubble: “Like all booms, higher education has been fueled by credit.”

If reducing interest rates on student loans will not achieve the goal of reducing higher education costs (and will actually increase them), what should be done instead? The answer lies not in government intervention and control, but rather the free market, Thornton said.

“Higher education would be more directed for the benefit of the students,” he said of a free-market structure. “The final product—the graduate—would be better educated. You would see more efficient institutions. The food would be better. The value of degrees would go up.”

Perhaps even more significantly, Thornton said he believes “institutions of higher education would start offering loans to students out of their endowments to be paid off after graduation. That would encourage the picking and recruiting of the best students, making sure they received the best training and education, and finally they would be concerned that students got the best job possible so they could pay off the loans.”

Thornton also suggested free markets for higher education could reduce costs by increasing institutional specialization and division of labor.

“Eventually majors like business, nursing, law, and criminal justice would tend to move off of university campuses and into specialized training schools which were for-profit,” he said. “College education would become more targeted to literature, arts, math, sciences, philosophy, history and economics (which it has a comparative advantage) and less an exercise in job training (where it does not—it has a tax advantage).”

Fix Contributor Joseph Diedrich is a student at the University of Wisconsin Madison.

Click here to Like The College Fix on Facebook.

PHOTO: Captain Skyhawk

Please join the conversation about our stories on Facebook, Twitter, Instagram, Reddit, MeWe, Rumble, Gab, Minds and Gettr.