For-profit colleges aren’t ‘voluntarily’ sharing their average debt levels

College students are racking up more debt for school in the Northeast and Midwest than the South and the West, according to a study by the Institute for College Access & Success.

Nearly seven in 10 graduating seniors from public and private nonprofit colleges in 2013 had some degree of student debt, said the press release by the nonprofit group, which promotes more available and affordable higher education.

The average debt for students amounted to $28,400, a 2 percent increase from graduates in 2012. Average debt loads for students at one in five schools jumped 10 percent or more in a single year, and fell at least 10 percent at just 7 percent of schools, the study found.

Reported debt levels may actually skew low because of the limited data set the study used. Only 57 percent of public and nonprofit bachelor’s degree-granting colleges provided data, representing 83 percent of 2013 graduates in those sectors. Too few for-profit colleges “voluntarily” provide their graduates’ debt levels for that category to be included at all.

Though there’s “great variation from college to college, with average debt figures from $2,250 to $71,350” among the 1,000-plus schools the study analyzed, some regions produce graduates with higher debt, it said.

New Hampshire, Delaware, Pennsylvania, Rhode Island Minnesota and Connecticut topped $30,000 for average student debt in 2013. New Mexico was the only state below $20,000. Average debt tops more than $35,000 at 129 colleges, the study found.

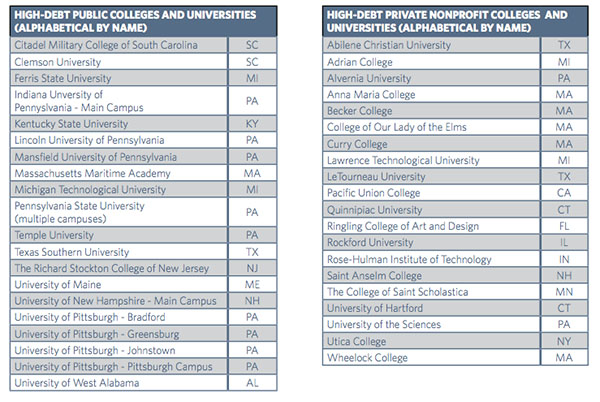

Colleges in Pennsylvania dominate the list of high-debt public schools ($33,950 and up), including four University of Pittsburgh campuses and “multiple” Pennsylvania State University campuses. High-debt private schools are more spread out, with high-profile names including Abilene Christian in Texas and Quinnipiac University in Connecticut.

Low-debt schools ($2,250-11,200) are split almost equally between private nonprofit and public, with three California State University campuses and four City University of New York campuses making the list. Princeton is on the list, as are two Appalachian schools specifically targeted at low-income students – zero-tuition Berea College and the College of the Ozarks, where students work in lieu of paying tuition.

“Graduates from New Hampshire colleges are almost twice as likely as Nevada graduates to leave school with student loan debt, and they owe almost twice as much as graduates from New Mexico colleges,” Debbie Cochrane, institute research director and co-author of the report, said in the release. “The importance of state policy and investment cannot be overstated when it comes to student debt levels.”

The study notes that around a fifth of the 2013 graduates’ debt is comprised of private loans from banks and lenders. It describes these as one of the “riskiest” ways to pay for college and “no more a form of financial aid than a credit card.”

“Private loans lack the basic consumer protections and flexible repayment options of federal student loans, such as unemployment deferment, income-driven repayment, and loan forgiveness programs,” the study reads.

To remedy the lack of data transparency for the short-term, the authors call for the Department of Education to track both federal and private loans through its Integrated Postsecondary Education Data System.

The report highlight one school’s wild debt swings year to year to illustrate the data’s weaknesses.

The nonprofit University of the Sciences in Philadelphia reported $71,370 debt for the average borrower in 2013, while the year prior the graduates averaged only $10,620 in debt. “Such a large change in a single year raises questions about both figures,” the study reads.

“This is too important an issue for students, schools, and policymakers to rely on voluntary, self-reported data,” said Matthew Reed, institute program director and co-author of the report. “Federal collection of both federal and private loan debt at graduation is both necessary and long overdue.”

For the long-term, the department should collect data through the National Student Loan Data System – which currently reports every federal loan – directly from private lenders, the authors said. Such a system would “provide accurate and comprehensive data on private loan borrowing while minimizing the reporting burden for colleges,” the study says.

Other policy recommendations include reducing the need to borrow by increasing the federal Pell Grant program, keeping loan payments manageable by raising awareness for repayment options and allowing students to apply for financial aid earlier to determine how much they are eligible for before they apply to school.

College Fix reporter Michael Cipriano is a student at American University.

Like The College Fix on Facebook / Follow us on Twitter

IMAGE: thisisbossi/Flickr

Like The College Fix on Facebook / Follow us on Twitter

Please join the conversation about our stories on Facebook, Twitter, Instagram, Reddit, MeWe, Rumble, Gab, Minds and Gettr.