student loans

-

Financial Aid Higher Ed Bubble Opinion Veteran and business owner leaves behind helpful student loan guide: book review

Financial Aid Higher Ed Bubble Opinion Veteran and business owner leaves behind helpful student loan guide: book reviewOPINION: A business owner and veteran created a quality college loan guide for parents and students.

-

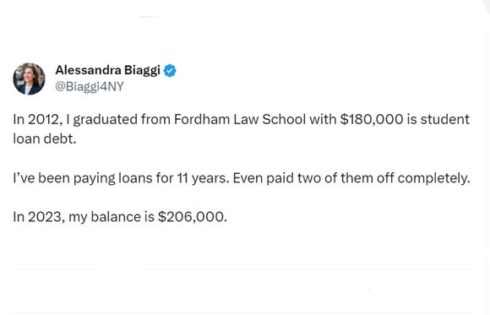

Financial Aid Higher Ed Bubble Politics Teacher quits jobs, then complains she can’t make $200 student loan payments

Financial Aid Higher Ed Bubble Politics Teacher quits jobs, then complains she can’t make $200 student loan paymentsANALYSIS: Media amplifies stories of people who quit their jobs and are now struggling to pay their debt.

-

Financial Aid Politics Democrat-sponsored legislation would refinance student loans to cancel interest

Financial Aid Politics Democrat-sponsored legislation would refinance student loans to cancel interestSponsors say taxpayers would not foot the bill.